Content

Here are some of the most common issues users still have with the software. Just add the person’s name and email, and they will receive a message and a link to connect to FreshBooks. Automatic permissions are set in FreshBooks, so you don’t have to worry about setting up permission levels when inviting team members. The My Team feature is useful if you have employees, but you can also use it for contractors and accountants. You can also pause time-tracking from within the timer, resuming the timer when you’re ready.

FreshBooks’ servers are housed in Rackspace’s data centers in addition to cloud-based security measures. To learn more about FreshBooks’ security and its partnership with Rackspace, contact the FreshBooks team. FreshBooks makes it easy to bill projects as an invoice when a project is completed. FreshBooks regularly offers promotional pricing for the first three months of a new contract, so be sure to check its website for the latest pricing.

When QuickBooks is best

In time tracking settings, you can establish whether you want to track time entries by duration or by start and end time. The software started out primarily as a solution for managing invoices and grew to become an accounting product. The Toronto-based company’s software is now used in more than 160 countries. The company charges users $10 per month for additional team members, a large percentage of the total monthly cost for the lower tiers. FreshBooks is known for an intuitive interface that’s easy to navigate. If you’re looking for a simple solution to organize your business accounting in one system, it won’t take long to get started with the basics and send your first invoice.

FreshBooks accounting software offers small businesses award-winning customer support. Our team has won 11 Stevie Awards, which are international awards given out to the absolute best customer support department in the world. It’s one of the biggest reasons our users prefer us over other accounting software. Wave has a free plan and is generally going to be a cheaper option. Both platforms shine with their highly intuitive and simple interfaces, and both have solid feature sets for small businesses.

Business Line of Credit: Compare the Best Options

For more options, check out our guide to the best invoicing software. You can work strictly from the project homepage to enter the time and expenses needed to complete your project, or you can use the tools provided outside of the project homepage. And no competitor in this group of applications offers tools like these. FreshBooks went through a major user interface overhaul a few years ago that dramatically improved its user experience.

Why is accounting important FreshBooks?

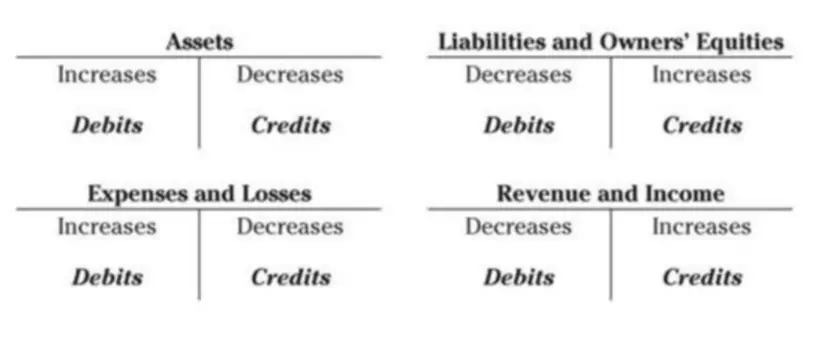

Accounting provides vital information regarding cost and earnings, profit and loss, liabilities and assets for decision making, planning and controlling processes within a business.

FreshBooks is an excellent accounting option for small businesses, boasting a sleek interface that is easy to use, a strong feature set, and multiple integrations. One of the https://www.bookstime.com/ coolest features of FreshBooks is the proposals feature. It’s well-developed and allows you to showcase your work with plenty of space for writing, images, and attachments.

Robust reports

If you want accountants to have access to your dashboard, reports, invoices and expenses, you can assign them permission, as well as grant other users access to different features. If you have employees, you can give them access to their projects, as well as track their time and additional expenses. Be aware, though, that business partners do not have complete control, since they can’t remove apps or integrations. And if you have business credit cards or small business loans, your bookkeeping can get complicated quickly. The cloud accounting platform’s wide array of features is one of the reasons why FreshBooks is a favorite of many small-to-mid-sized businesses.

She faced the challenge of starting with no revenue and no set processes for bookkeeping and getting paid. Using FreshBooks software and Bench bookkeeping services to handle payments, invoices, and expenses, she was able to grow the company’s revenue and jumpstart the business with confidence. It also has tools for accounts payable, project profitability, customization, and automation. The developers of Freshbooks keep small teams in mind when developing the software. Hence, they continue to constantly reinvent the wheel of how midmarket accounting should be done and eliminating even the slightest possibility of human errors that lead to harmful inconsistencies.

If you have a mid-sized or fast-growing business

Your customers can make payments to you using FreshBooks’ own payment function, which is in fact a rebranded version of payment processing service WePay. It costs 2.9% plus 30 cents per transaction and 1% for bank transfers (ACH), which is effectively the industry standard. FreshBooks streamlines the creation of accounting reports by pulling in data from invoices, payments, expenses, and your bank account.

All you need to do is assign the project to a client, enter the project services you’ll provide, and enter either the flat-rate amount or the hourly rate for the project, and you’re good to go. Creating a project can be particularly helpful if you tend to forget to track your time properly since https://www.bookstime.com/articles/freshbooks potentially every service you sell can be a project. Use your Intervals account to create detailed or hi-level invoices based on the actual work you’ve performed. Intervals will neatly package your billable time into presentable invoices with a level of clarity and detail your clients will love.