Content

Regular divergence reflects waning trend strength and market momentum. Therefore, it is considered a strong signal of a market reversal. It can be bullish and bearish, meaning it predicts a downtrend and uptrend reversal, respectively. The Bitcoin daily chart pictured above shows a bullish divergence between price action and the Relative Strength Index (RSI – Purple line).

Combining trading signals with price action and trend direction is best to achieve more accuracy. To identify an advanced bearish divergence, you should keep an eye on the highs (or peaks) of the price and the indicator charts. You can identify an advanced bearish divergence by the highs of a large price movement. The market forms a kind of double top but note that the double top does not have to be classic. The second maximum can be slightly higher or lower than the first one.

- Look what happened next, the price made a bear move right after the divergence.

- We will help to challenge your ideas, skills, and perceptions of the stock market.

- If the downtrend is unable to reach 30 or below and then rallies above 70, that downtrend has weakened and could be reversing to the upside.

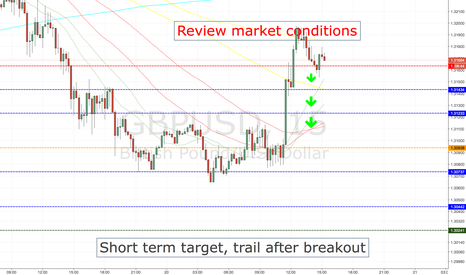

- On this chart below, the RSI formed a bullish divergence on the GBP/USD daily chart.

- Pivot points are an excellent leading indicator in technical analysis.

- The minimums are approximately at the same level on the price chart, resembling a double bottom.

In other words, a chart might display a change in momentum before a corresponding change in price. As you can see in the above chart, the RSI indicator can stay in the overbought region for extended periods while the stock is in an uptrend. The indicator may also remain in oversold territory for a long time when the stock is in a downtrend. This can be confusing for new analysts, but learning to use the indicator within the context of the prevailing trend will clarify these issues.

REAL-TIME STOCK ALERTS SERVICE

The hidden bullish divergence occurs when the price chart (the market) is moving upwards and draws the higher lows. In this case, the indicator is displaying the divergence and draws a lower minimum. To identify a common bullish divergence on the Forex market, you should keep an eye on the minimum (or lows) of the price chart and the indicator. Common bullish divergence occurs when the price chart shows a lower minimum and the indicator chart shows a higher minimum. Like I have said before, you don’t need to wait for a series of the lower minimum on the price chart. You just need to see one lower minimum compared to the previous one.

As price broke above the previous Lower high, we execute a buy trade by placing stop-loss few pips below the structure level (Geen zone). Even though the market creates low the RSI is doing the opposite thing this indicates ongoing downtrend is losing its momentum and we should prepare for a reversal. Now if you look to the left of this chart, you can see that it is a downtrend with a series of lows and lower highs.

Divergence signals tend to be more accurate on the longer time frames. If you spot divergence but the price has already reversed and moved in one direction for some time, the divergence should be considered played out. The highs or lows you identify on the indicator MUST be the ones that line up VERTICALLY with the price highs or lows. Harness past market data to forecast price direction and anticipate market moves. From beginners to experts, all traders need to know a wide range of technical terms. And that’s our trigger to trade our divergence chart pattern.

RSI divergence crypto trading strategy example

We realize that everyone was once a new trader and needs help along the way on their trading journey and that’s what we’re here for. We want you to see what we see and begin to spot trade setups yourself. Trading contains substantial risk and is not for every investor. An investor could potentially lose all or more of their initial investment. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

However, these numbers are just guidelines and should not be used when you plan to go short or long with a stock. Instead, use RSI as a secondary indicator to support a separate primary buy or sell indicator. But keep in mind that this is not a HOLY-GRAIL trading strategy.

Now we know that the ongoing uptrend is losing momentum and result of that the price ended up forming a descending triangle pattern. Just like the previous example, the market was in an uptrend and eventually the price start to slow down. According to the above chart, you can see that the market was in a strong uptrend but right now the price action starts to slow down. Have a look at the RSI divergence marked in the chart above, this indicate weaknesses of this uptrend. A Divergence occurs on your chart when the price action and RSI indicator are out of the sync.

Types of stock exchange listings

Therefore, while the price is moving, the RSI is telling us in advance to anticipate a change in the direction. Opposite to this, having the RSI line in the oversold area (0-30 area) implies that the selling intent was so high that the bears might need a break. If the RSI line is in the 0-30 area, we have a long signal, implying that the price might reverse in bullish direction. A bearish failure swing forms when RSI moves above 70, pulls back, bounces, fails to exceed 70 and then breaks its prior low.

The reason for this is that it hints for an upcoming bearish move, which you can tackle with a short trade. The negative RSI divergence is opposite to the positive divergence. It applies to bullish trends where the price closes higher highs and higher lows. However, the RSI accounts for lower highs and lower lows – the price increases but the RSI decreases. Generally, an RSI divergence means that the RSI indicator is moving in the opposite direction compared to the price.

Therefore, a trader could have utilised the opposite cross of EMAs (2) or placed take-profit targets at the nearest resistance levels. In both cases, as the price climbed toward its peak, the RSI posted a downward pattern, indicating a market reversal – or bearish divergence. In technical analysis, when the price is making higher highs, then the oscillator should also be making higher highs. The oscillator should also make lower lows if the price makes lower lows. We need two completed bars to the right side of the swing high/low to confirm a divergence signal. Sometimes, waiting for the two completed bars can delay trade entry to a greater extent.

Medium Bullish Divergence

When it comes to the speed we execute your trades, no expense is spared. Harness the market intelligence you need to build your trading strategies. No matter your experience level, download our free trading guides and develop your skills. Here’s a comprehensive summary of the information you need to trade effectively using RSI divergence. As an alternative, trading using fibonacci to get the entry point is also a good option. Basically, we are waiting for a pullback after the divergence appeared.

The question is therefore which technical analysis tool is the most appropriate to compare with the evaluation of an asset’s price. The RSI is the most commonly used indicator in technical analysis. Its purpose is to study the relative strength of upward and downward movements in the price of an asset. In a strong uptrend, RSI will often reach 70 and beyond for sustained periods, and downtrends can stay at 30 or below for a long time.

Many investors surround themselves with a complex ecosystem of technical indicators. The technique we’re discussing here offers signals that are very easy to interpret. On the other hand, when a bullish divergence appears on our charts, we should be careful because a trend change to the upside may be imminent. When we spot a bearish divergence, we should expect a change in the trend from bullish to bearish. An RSI divergence is a chart pattern where the RSI indicator is not synced with the price action. (1) When the RSI makes similar highs during an uptrend it means that the momentum of the trend is unchanged.

A cross below 30 indicates that the ticker is undervalued. The Relative Strength Index (RSI) is a momentum (MOMO) indicator originally developed by J. The development of the RSI was to measure the magnitude of change in price action while offering signals of “overbought” or “oversold”conditions.

Introduction to RSI

Oscillators like the RSI indicator fall within a basic group of technical analysis tools. One of the most powerful functions of oscillators is the ability to identify price divergence. Today we will examine techniques for spotting and trading RSI divergence patterns.

If the market moves upwards, the oscillator also moves upwards. When the market draws a higher maximum, the oscillator also draws a higher maximum. So you’ve connected either two tops or two bottoms with a trend line. Now look at your preferred technical indicator and compare it to price action. Join thousands of traders who choose a mobile-first broker for trading the markets. A popular technique in most financial markets, RSI divergence is an effective tool for buying or selling at the right time.

When an indicator disagrees with the price, this lack of synchronicity indicates a likely change with the chart. RSI Divergences is an indicator that shows where RSI and price are in a divergence. Instead of taking just based on RSI Divergence and chart patterns, It is better divergence rsi indicator to combine these two factors with highly profitable trade location like support and resistance. We wait for a break below the descending the triangle and then place the sell order. As you can see pairing RSI divergence with chart patterns resulted in high profitable trades.

Just like the overt divergence setups, hidden divergence setups can be of the bullish or bearish variety. The bullish divergence RSI setup shows two troughs in the RSI indicator window forming higher lows while the price shows lower lows. The RSI, therefore, leads the price action and is pointing in the new direction. The price follows directly after to correct the divergence in the direction of the indicator’s signal. Location is a universal concept in trading and regardless of your trading system, adding the filter of location can usually always enhance the quality of your signals and trades.